The fintech sector has rapidly expanded and changed during the last few years.

Fintech startups have greatly impacted established banking and financial institutions by providing more accessible, effective, and user-friendly financial goods and services. Fintech startups integrate cutting-edge technology with new financial services.

These firms use cutting-edge technology like machine learning, blockchain, and artificial intelligence to provide new financial services and solutions that meet changing customer demands.

Traditional financial institutions have been put to the test by fintech startups, compelling them to embrace innovation and adopt new technology in order to stay competitive.

It is important to understand the influence of these startups on the financial services environment as well as the potential and problems they bring for customers and the larger economy as the fintech sector continues to develop.

This article will explore the ecosystem for fintech startups, the technology fostering their development, and any potential repercussions for customers and established financial institutions.

15+ Best Fintech Startups (2024)

Let’s quickly dive into the 15 best Fintech Startups in 2024.

1. Digit

| Location | San Francisco, California |

| Funding | Series C, $66.3 Million |

| Investors | Oportun, Financial Venture Studio. |

| Founded In | 2016, |

Digit is a fintech startup that offers a range of digital insurance products, including health, travel, and life insurance.

Founded in 2016, Digit aims to simplify the insurance buying process by providing affordable and easy-to-understand insurance policies that cater to the needs of modern consumers.

Digit leverages artificial intelligence and machine learning to offer personalized insurance products that are tailored to each individual’s needs.

The company’s digital platform provides an intuitive user experience that enables customers to purchase insurance policies online, manage their policies, and file claims seamlessly.

2. TrueLayer

| Location | London, United Kingdom |

| Funding | Series D, $141.8 Million |

| Investors | Tiger Global Management, Stripe |

| Founded In | 2016 |

Truelayer is a London-based fintech startup that provides open banking infrastructure and services to financial institutions and fintech companies.

Its open banking platform allows developers to build applications that can connect to customers’ bank accounts, enabling them to make transactions, manage finances, and access financial data in real time.

3. Thought Machine

| Location | London, United Kingdom |

| Funding | Series B, $148.6 Million |

| Investors | Eurazeo, ING Ventures |

| Founded In | 2014 |

Thought Machine provides a cloud-based banking platform for traditional banks and other financial institutions.

The company was founded in 2014 by a team of experienced technologists and financial industry experts with the aim of providing an alternative to the legacy banking systems that are still in use by many financial institutions today.

Thought Machine’s platform has helped to drive innovation in the banking industry, enabling traditional banks to compete with digital-only banks and other fintech startups.

4. Rocket Money

| Location | Silver Spring, Maryland |

| Funding | Series D, $83.9 Million |

| Investors | Cota Capital, Eldridge |

| Founded In | 2015 |

Rocket Money is a digital mortgage platform, making the mortgage application process faster and more efficient for consumers.

It enables customers to apply for a mortgage online, using a simple and intuitive interface that guides them through the application process step-by-step.

The platform uses advanced technology to streamline the mortgage application process, enabling customers to receive a decision in principle within minutes, rather than days or weeks.

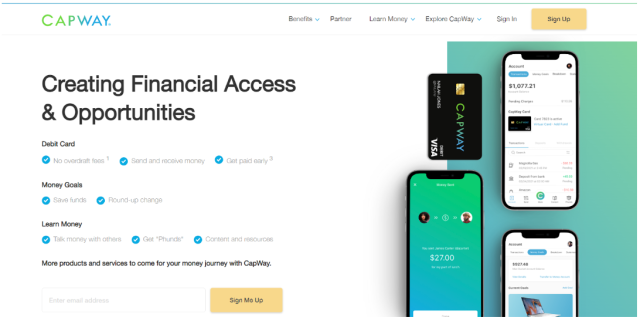

5. CapWay

| Location | Atlanta, Georgia |

| Funding | Seed, $145,000 |

| Investors | Fearless Fund, Lombardstreet Ventures. |

| Founded In | 2017 |

CapWay is a digital banking startup that is designed to help underserved and underbanked communities gain access to financial services.

Capway’s digital banking platform is accessible through a mobile app that allows users to manage their finances, track their spending, and receive financial education and guidance.

The platform also includes a prepaid debit card that can be used for online purchases, bill payments, and ATM withdrawals.

6. Stori

| Location | Mexico City, Mexico |

| Funding | $399.6 Million |

| Investors | GGV Capital, BAI Capital |

| Founded In | 2017 |

Stori is a Mexico-based fintech startup that provides a mobile app for managing personal finances, with a particular focus on providing access to credit for underserved populations.

Stori has partnerships with several leading financial institutions, including Visa and Mastercard. The company has also received significant investment from major investors, including Lightspeed Venture Partners and Ribbit Capital.

7. Chipper Cash

| Location | San Francisco, California |

| Funding | $302.2 Million |

| Investors | Nevcaut Ventures, SVB Capital |

| Founded In | 2018 |

Chipper Cash is a US-based fintech startup that provides a mobile app for sending and receiving money across Africa.

The company was founded in 2018 by Ham Serunjogi and Maijid Moujaled with the goal of making it easier and more affordable to send and receive money in Africa.

Chipper Cash has received significant investment from major investors, including Jeff Bezos, Ribbit Capital, and Sequoia Capital.

The company has also been recognized for its innovative approach to fintech and has won several awards, including the Best Fintech Startup at the AppsAfrica Innovation Awards in 2019.

8. Luma Financial Technologies

| Location | Cincinnati, Ohio |

| Funding | $30.1 Million |

| Investors | N/A |

| Founded In | 2018 |

Luma Financial Technologies offers a digital platform for financial advisors and their clients to access and manage alternative investment products.

It allows financial advisors to access and manage a wide range of alternative investment products, including private equity, real estate, and hedge funds.

The platform provides access to institutional-quality alternative investments that were previously only available to high net worth individuals and institutional investors.

9. Chime

| Location | San Francisco, California |

| Funding | $2.3 Billion |

| Investors | General Atlantic, Tiger Global Management |

| Founded In | 2013 |

Chime is an american neoback that was founded in 2013 that offers a mobile baking app and a wide range of financial services to customers.

It has quickly become one of the most popular online banks in the United States, with more than 12 million users as off 2021.

The main focus of Chime is to provide fee-free bankin services. It also offers access to more than 38,000 fee-free ATMs through its partnership with MoneyPass.

Users can easily build their credit score by using their chime accoun to p=make payments on a credit builder card.

10. Figure

| Location | San Franciso, California |

| Funding | $1.6 Billion |

| Investors | Rockaway Blockchain Fund, L1 Digital |

| Founded In | 2018 |

Founded in 2018, Figure has quickly become a leader in the fintech industry.

It has a strong focus on using blockchain technology to streamline and simplify the lending process.

The key product offered by Figure is home equity loans. This startup uses blockchain technology to facilitate a fast and efficient loan origination process.

Along with personal loans, Figure also offers a variety of financial services. The ‘Figure Pay’ platform allows users to make payments using cryptocurrency.

Figure uses blockchain technology that makes sure to secure and streamline its financial services.

11. Settle

| Location | Dan Francisco, California |

| Funding | $376 Million |

| Investors | Citibank, Atalaya Capital |

| Founded In | 2019 |

Settle offers a range of financial services to businesses and individuals. It offers digital wallet that allows users to store and manage multiple currencies.

The wallet can be used for a range of transactions, including sending and receiving money, making payments, and exchanging currencies. It is accessible through a mobile app, which is available for both iOS and Android devices.

Moreover, Settle provides payment gateway that allows businesses to accept payments online. The payment gateway can be integrated with a range of e-commerce platforms, including Shopify, WooCommerce, and Magento.

Settle also offers a range of payment options, including card payments, bank transfers, and digital currencies.

12. UNest

| Location | North Hollywood, California |

|---|---|

| Funding | $38.8 Million |

| Investors | Ksenia Yudina |

| Founded In | 2018 |

UNest is all about creating a financial future for children. It offers a mobile app that helps parents save for their children’s future education.

The company gives parents a way to invest funds for their children’s future education expenses, such as college tuition, room and board, and textbooks.

The investment gains in the account are tax-free as long as they are used for qualifying education expenses.

13. Affirm

| Location | San Francisco, California |

| Funding | $1.5 Billion |

| Investors | SV Angel, GGV Capital |

| Founded In | 2012 |

Affirm is a credit based digital financial institution that allows people all over the world to buy now and pay later.

It has gained more customers because of its installment loans, which allow consumers to split the cost of purchase into smaller, more manageable payments over time.

Affirm’s installment loans have no hidden fees or compounding interest and are typically available at lower interest rates than credit cards.

Customers can apply for an Affirm loan online or at the point of sale with participating merchants.

14. Brigit

| Location | New York, New York |

| Funding | $113 Million |

| Investors | Community Investment Management, Lightspeed Venture Partners |

| Founded In | 2017 |

Brigit is made to help Americans manage their finanaces and avoid overdraft fees.

Brigit provides cash advance service, which allows users to access up to $250 of their next paycheck without any fees or interest charges.

The cash advance is automatically repaid from the user’s bank account on their next payday, making it a convenient option for those who need a little extra cash to cover unexpected expenses.

Brigit also offers a range of budgeting tools designed to help users better manage their finances.

These tools include personalized spending insights, alerts for low balances, and the ability to track bills and subscriptions. The app also provides resources and tips for improving credit and managing debt.

15. Nav.It

| Location | Seattle, Washington |

| Funding | $3.3 Million |

| Investors | Copper Wire Ventures, Thirsteam Partners |

| Founded In | 2016 |

This fintech startup offers a money management app that helps users measure, integrate and be mindful of their spending habits.

It became more popular because of its budgeting and financial tracking tools. Users can link their bank accounts, credit cards, and investment accounts to the app to get a comprehensive view of their finances.

Nav.it also offers a range of features designed to help users achieve their financial goals. These features include savings challenges, where users can set savings goals and track their progress over time, as well as educational resources on personal finance and investing.

Related Read:

Final Thoughts: Fintech Startups (2024)

So, finally, here we are with the best fintech startups to watch in 2024.

As we have seen, fintech startups are driving significant changes in the financial industry.

They offer innovative solutions to help consumers manage their finances more efficiently and effectively.

Whether it’s budgeting tools, cash advance services, or investment management platforms, fintech startups are using technology to make financial products and services more accessible, affordable, and convenient for consumers.

As the fintech industry continues to evolve, we can expect to see even more disruption in the traditional financial sector and more innovative solutions to help people achieve their financial goals.

With the potential to democratise finance and promote financial inclusion, fintech startups are set to play a key role in shaping the future of money.

I hope this articl ehelped you to understand and explore the Finntech Startups that are booming in 2024.

What are your thhoughts on this? Let us know in the comment section below.

- Do Middle School Grades Matter in 2024? - February 28, 2024

- 10 Best Dropshipping Courses Of 2024 (Top Rated) - February 24, 2024

- How To Become A Chef In 2024 (Guide) - February 19, 2024